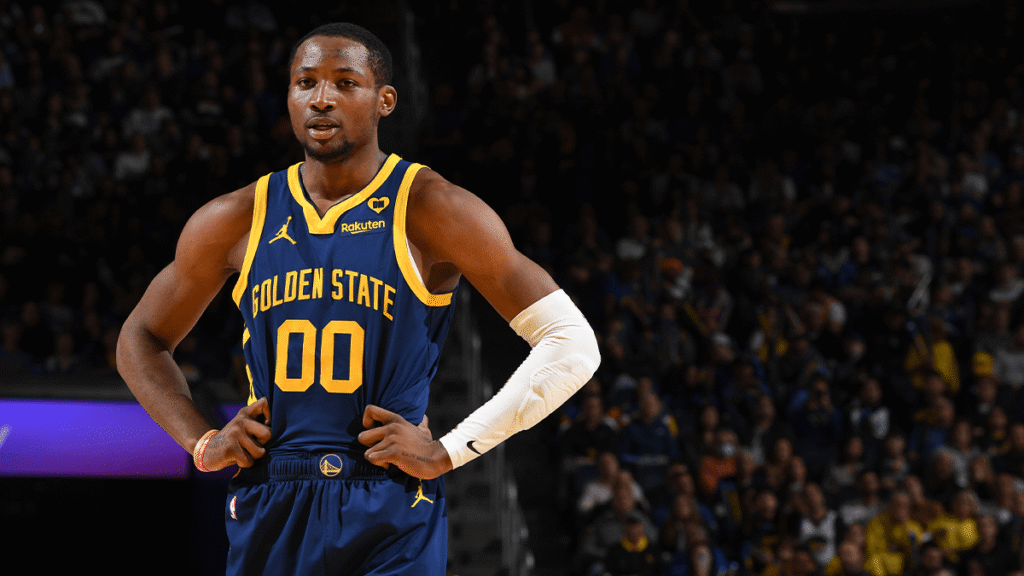

Even though all signs thus far indicate Jonathan Kuminga likely will leave the Warriors this summer, the finances could make that tricky.

The Athletic’s Anthony Slater noted a few interesting wrinkles to the situation and why he believes the best possible outcome for all parties would be for Kuminga to remain in the Bay.

First, with Kuminga expected to earn at least a 20 percent raise as a restricted free agent, a new deal would put Golden State over the cap. But the incoming salary would only count as half of Kuminga’s outgoing salary, as noted by the “base year compensation” rule in the CBA.

So, as Slater notes, if Kuminga’s new deal starts at $30 million, which is what his next team would absorb it as, the Warriors would look at a $15 million incoming match.

As a restricted free agent, Kuminga could sign with Golden State or sign an offer sheet with a team with cap space. The Warriors would have the right to match.

A sign-and-trade is also a possibility. But as Slater pointed out, the base-year rule in addition to the first-apron cap “significantly limits” the number of realistic sign-and-trade opportunities for the Warriors.

“The Warriors’ front office, Kuminga’s representatives and the league are expected to explore all options into July,” Slater wrote. “But team sources have been hinting that, because of these market and financial restrictions, there’s a likely world where the most obvious and prudent path is for them to bring Kuminga back and figure the rest out later.”

After numerous DNPs-CD (Did Not Play, Coach’s Decision) to begin Golden State’s postseason run, Kuminga re-emerged into Steve Kerr’s rotation when Steph Curry went down with an injury and reminded the Warriors and the rest of the league of his talent and athleticism.

And that talent and athleticism might be on a one-way trip back to the Warriors.

Download and follow the Dubs Talk Podcast

Read the full article here